best online broker australia 2022

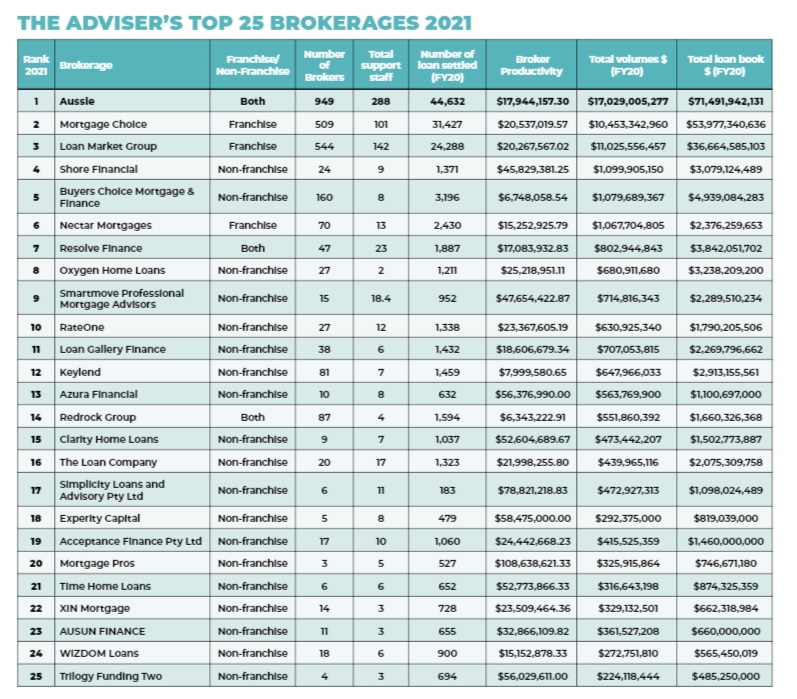

The top brokerages in Australia have been revealed in The Adviser's Top 25 Brokerages ranking for 2021.

Partnered by NAB

A word from NAB

The significant challenges of the past year have proven the services provided by brokers to the Australian community are essential.

Even as the COVID-19 pandemic continues to reshape the way we live and work, the primary focus for brokers remains on how they can best service their customers and achieve the best outcomes.

Brokerages at the top of their game build strong customer relationships, provide exceptional personal service and help Australians with some of the most important financial decisions of their lives.

As the bank behind brokers, NAB is proud to be championing the great work of these Top 25 Brokerages who have supported home and business owners through a challenging 12 months.

As the world continues to change, we believe the heart of the broker value proposition will remain consistent with an enduring focus on delivering the best possible customer outcomes and enhancing competition in the market.

NAB will continue to invest in the broker channel as a true indication of the value we place on this crucial partnership, with a spotlight on professional development and educational tools to support vital evolution and improve professionalism.

On behalf of NAB I would like to congratulate this year's standout brokerages for leading the way in their commitment to putting customers first and providing exceptional service.

Nicole Triandos

Acting general manager, NAB, broker distribution

The financial year 2020 was one that turned all expectations on their head. While the second half of 2019 was performing relatively well, with the federal government touting that the country would be 'back in the black' by the end of it, things were turned on their head once the COVID-19 pandemic hit and the lockdowns and restrictions shuttered businesses and brought the country into recession for the first time.

But as we adjusted to life in the new normal, the final quarter of the financial year saw things starting to look up – with low unemployment figures, lower numbers of insolvencies and a strong mortgage market. In their droves, borrowers looked to save money by refinancing their mortgage and taking advantage of generous cashback offers. Meanwhile, government measures (such as the HomeBuilder and First Home Loan Deposit Scheme) were massively successful in ensuring the property market stayed strong with first home buyers, too, with more and more borrowers looking at getting onto the property ladder.

Indeed, brokers were busier than ever in FY20 (and even more so in the second half of the year), with data released by research group comparator, a CoreLogic business, and commissioned by the MFAA showing that mortgage brokers settled $52.8 billion of new home loans during the June 2020 quarter, the largest observed result by value for any quarter since the MFAA first reported this data.

Moreover, brokers recorded their highest market share result in over a year by facilitating 57 per cent of all new residential home loans in the April-June 2020 quarter, a figure which rose to new record levels in the first quarter of FY21 (when it hit 60 per cent for the first time).

As the figures for The Adviser's Top 25 Brokerages ranking 2021 show, settlements were strong across the board.

The major brokerage brands continue to dominate in settlement figures. Aussie Home Loans and Mortgage Choice maintained their top two positions for another consecutive year, while the Loan Market Group maintained its third position for the third year in a row.

Sydney-based brokerage Shore Financial was the only broking group without an aggregation offering that made the top five this year, rivalling the big groups to come in fourth place (with $1.1 billion in loans settled in FY20). As CEO Theo Chambers told us in his interview, the brokerage is now set on becoming a mortgage manager – and will be building out that capability this year.

Victoria-based Buyers Choice Mortgage & Finance achieved a top five ranking for the first time after it jumped two places from last year's rankings.

Meanwhile, North Strathfield brokerage Mortgage Pros – headed up by Russell Munfaredi – was the top brokerage for broker productivity, with its three brokers writing a whopping $326 million across 527 loans in FY20, an average of $108.6 million each!

*NB: The ranking in the print edition of The Adviser magazine (February 2021) contained an incorrect version of this ranking. The ranking above is the correct and final version of this ranking.

How is the ranking compiled?

The Top 25 Brokerages ranking is based on figures from the 2020 financial year.

Each brokerage was asked to provide several business metrics from 2020, including volumes, number of loans written, years in business, overall book size, number of brokers, number of support staff and more.

The information published is based solely on what was provided by brokerages.

How was the ranking scored?

The final ranking was determined by scores in six key areas: total book size, total loans selected in 2020, total volume of loans settled in 2020, book size versus years in business, total number of brokers and average broker volumes for 2020 (i.e. volume numbers divided by actual number of brokers).

Each of the brokerages that entered was given a ranking score in each category from 1 to 25 (1 being the best).

The six scores were then added to give a final overall score. The lower the score, the better the ranking.

Top tips from the top 5 brokerages

The broking industry stepped up its game in 2020, helping more borrowers than ever manage their mortgages – writing more than 60 per cent of all home loans, according to MFAA data. As the numbers in the ranking reflect, many of the brokerages this year experienced a surge in applications and business, more so than pre-COVID. We ask the heads of the top five brokerages how they have been operating successful businesses in these peculiar times.

01. Aussie Home Loans

Maintaining its lead in the Top 25 Brokerages ranking this year is the CBA-owned brokerage Aussie. CEO James Symond explains why more borrowers were flocking to Aussie brokers in 2020 than before COVID, and the group's plans for the future.

What do you attribute to Aussie's success?

Aussie has always operated with a 'family style business' mentality. So, we focus on having the right people that believe in our purpose, and support them with the tools and development they need to succeed in a changing environment.

Ultimately, it's this unique blend of culture and purpose that have brought Aussie to where it is today, despite the challenges along the way. Our people are resilient, we embrace change – and change is what we built this business on.

What was Aussie's biggest achievement in 2020?

2020 was a stellar year for Aussie, and our business has never been stronger.

Total settlements were up by 10 per cent from the previous year, and September also signalled Aussie's largest volume month on record. In addition, we achieved our best ever October settlement and lodgement month on record, thanks to a combination of favourable market conditions and strong growth in franchisee numbers.

Our customer volumes remain up significantly year-on-year, and we're making an impact on our customers with our Net Promoter Score results thriving at almost 80 per cent.

We boosted technology, too, pouring money into new systems and processes for team members, customers and brokers. This includes new sales tools, which were rolled out in partnership with the world-class digital Salesforce CRM.

What was the biggest change/initiative you made last year to help brokers support their customers during COVID?

While other businesses put the brakes on spending and recruiting during COVID, Aussie boldly forged ahead with an aggressive multimillion-dollar growth strategy.

We invested over $16 million on marketing the brand, with half of this spend activated during COVID. We were committed to supporting our brokers, and we went harder on their behalf with TV ads, bespoke commercials and digital campaigns. Almost 90,000 Australians had appointments with an Aussie broker during 2020 – more than last year pre-COVID.

Aussie also launched a new recruitment campaign, to invest in growing our broker network to take us to the next level and ultimately help more Australians with their home loan needs. The recruitment campaign offers a start-up cash incentive, helping new brokers transition into their business. Aussie has attracted high-calibre people from outside the finance industry, including hospitality, retail and the airline industry.

For our existing franchisees, we are also offering a program which provides incentives to refresh or refit their retail stores to give them the boost they needed to continue their exceptional work for their customers.

Personally, I'm confident there would not be another mortgage broker in this industry that spends the amount of money, time and effort on ongoing training, learning and development with brokers than Aussie. We're also spending more money on technology today than we've ever spent. I want to make sure our brokers are armed with the best tools on the planet to build a high-quality business.

What will you be focusing on for the next six months?

We have ambitious plans for the next six months. We will continue to grow our franchisee numbers in order to have more feet on the ground to service the growing financial needs of our customers. Long term, our focus will be on growing the network to add 200 brokers to the network and grow our retail store presence to 300 Australia-wide by 2023. Our goal is to ensure that any customer anywhere can talk to a local broker.

We will continue to invest in our diversified products and services and ensure that we continue down the path of meeting a wide range of customers' property and finance needs, in more innovative ways.

Consumers have never had better service than ever before; everyone's plugged into more technology, and we've applied more customer tools. We are committed to continue enhancing our digital platforms in order to drive greater business efficiency for our brokers and customers.

The proposed merger with Lendi is another important step in the almost 29-year evolution of Aussie as Australia's leading retail mortgage broker. We are currently posting record lending volumes through our network, and with the underpinning Lendi's technology across our national broker network, we will further accelerate this growth and momentum.

MY TOP TIPS

Agility, including being able to react quickly to market changes and navigating a changing regulatory environment, is the key to running a leading brokerage.

On a personal level, I'm as focused as ever, and I'm as aggressive as ever. If you want to run a leading brokerage, you have to be committed and believe in yourself – and your vision."

– Aussie CEO James Symond

02 Mortgage Choice

Timely communication was key for the brokerage in 2020, CEO Susan Mitchell says, outlining that both brokers and their customers valued receiving information on how COVID-19 was impacting the mortgage market over the year. Good communication and a range of ready-to-go marketing materials was key to seeing an uptick in refinances, Ms Mitchell outlines.

What do you attribute to Mortgage Choice's success?

Year after year, mortgage brokers across our network have shone in the face of adversity. In 2019, it was dealing with the fallout from the royal commission, where broker business models were challenged. In 2020, it was working through bushfires, floods and COVID-19, as well as a sharper regulatory environment.

What impressed me last year is the entire business didn't skip a beat, even during the most difficult challenges. All our offices adapted and worked through lockdowns and restrictions; they embraced working from home, and most importantly they managed to keep franchises, staff and customers safe.

It's our catchcry that we are "stronger together", and this couldn't have been more true this past year.

What was Mortgage Choice's biggest achievement in 2020?

Knowing that we successfully worked through a global pandemic is certainly a big achievement, so that obviously ranks high. But there were also two other major achievements in 2020 that we see as longer-term investments in our business and these must be recognised.

The implementation of a formalised best interests duty (BID) program across the group is something that I know will benefit our brokers and their customers, as well as the entire industry, for decades to come. Rolling out a comprehensive BID learning and development program (which is ongoing) across the network was a major stepping stone to our future success, as was the subsequent technology improvements to our Broker Platform, and these are a truly collective effort.

Another major achievement was the strengthening of our broker and customer communications. May 2020 was a clear example, where we saw the highest monthly leads in three years (up 79 per cent from 2019).

Customers looked to experts they know and trust when the pandemic was peaking, and the surge in demand came from quality and timely communication from our brokers to their clients.

What was the biggest change/initiative you made last year to help brokers support their customers during COVID?

Our head office team quickly developed a targeted customer communications strategy once the pandemic hit and demand for broker services was surging. The success of this response meant that our network's customers and leads felt informed with timely and professional information. Over April and May, the team sent more than 1.5 million emails to existing customers and leads.

We created a COVID-19 financial support webpage that assisted our customers to be on top of the latest information regarding home loan repayment holidays and credit policy among other crucial announcements. The content was also shared across social media – and it was all about equipping our customers with factual and timely information from their broker, while also reassuring them that they were just a phone call away.

We also distributed weekly credit video updates to our brokers covering the fast-paced changes in policy, pricing and processes that we saw from lenders in response to the impacts of COVID-19.

This activity saw an increase in refinancing submissions of 50 per cent, and an increase in the total number of mortgage applications of 17 per cent in the three months to May 2020, when compared with the same period in 2019.

What will be the brokerage's main points of focus for the next six months?

We know that home buyers are entering the market at record levels. This presents an enormous business opportunity for our franchise owners, and new brokers to our network. Our primary focus is to support our network to grow their businesses in this unique environment. We are looking for new brokers to join us – brokers who want to successfully run and grow a mortgage brokerage business. That is our mission.

MY TOP TIPS

"Listen to your customer. A leading brokerage must understand what drives their customers and how, as a business, it can provide value for customers and help them flourish financially. If you're not adding value, then you're missing the mark."

– Mortgage Choice CEO Susan Mitchell

03 Loan Market

Since last year's Top 25 Brokerages ranking, Loan Market has grown its broker network and announced that it is to acquire NAB-owned aggregators Choice Aggregation Services, FAST and PLAN. Andrea McNaughton, the group's executive director of network success, outlines how the group has been growing.

What do you attribute to Loan Market's success?

Loan Market makes four promises to our brokers; we promise to save them time, keep them safe, help them find and keep clients, and grow their business. These four promises are etched on our wall and are at the heart of every decision we make on how we support our brokers and teams.

Our multiaward-winning tech platform, MyCRM, is a common thread in our four broker commitments, meaning we not only make promises but deliver on them through a platform that allows brokers and their support teams to work faster.

Our Kaizen-led step-by-step process for compliance and customer experience, The Loan Market Way, keeps our broker BID-safe and operates entirely within MyCRM. This creates a smooth and efficient digital journey from the first client meeting to ongoing post-settlement service.

We also have an unrivalled support structure, with a 1:50 ratio of broker success managers to brokers, daily online training, regular policy and lender communication, monthly webinars, community and learning programs for our customer service managers to help drive efficiencies within our brokers' businesses, and regulatory and compliance coaching and reports to ensure our network has a detailed understanding of their audit results and the ways in which they can improve.

These are some of the reasons Loan Market has been voted, by our brokers, the #1 Aggregator of Choice for three years in a row and what we attribute our success to.

What was the brokerage's biggest achievement in 2020?

Our recruitment volumes in 2020 were the best measurement of how we were supporting brokers ahead of 2021. We recorded a 63 per cent increase in new business leaders compared with 2019's new broker intake. We welcomed more than 220 new brokers. When we asked new recruits what was the reason for their move, they routinely mentioned 'tech and performance-based culture'.

Businesses want to future-proof their models, and we're very proud we've helped our brokers do that over 2020.

Our performance-based culture was evident in our improved productivity. Over 2020, the average lodgement for a Loan Market broker went from 35.2 for the six months to March to 38.4 for the six months to September, and finished 2020 more than double the industry average for broker productivity.

Supporting productivity, Loan Market launched a major client service manager (CSM) drive in 2020. Over 12 months, we are working with brokers to induct and train another 250 CSMs in The Loan Market Way to further strengthen productivity. We also proactively assist brokers with the recruitment of loan writers.

What was the biggest change/initiative you made last year to help brokers support their customers during COVID?

Whether it was Google Meet, Zoom or other video platforms, we made sure brokers felt connected to us and each other during COVID-19.

We held 30-minute 'Thrive' sessions every day, where we introduced new brokers to our digital tools and provided a refresher for existing brokers. We also began virtual Broker Small Group sessions facilitated by broker success managers, with the agenda set by attendees; this was an opportunity to check in on mental health, workshop deals, discuss lender policies and answer questions on new tech. These sessions made up part of our 20+ hour virtual training and support calendar introduced during COVID.

Equally, the interaction between brokers and their customers was critical. Our brokers could complete the full application journey with their customers using video calls, collect financial statements through the Online Fact Find, sign documents through eSign, and verify customers' identities digitally. We introduced numerous technology solutions that made social distancing possible while safeguarding against any drop in customer volumes. Our brokers helped more customers in 2020 than the year prior.

In fact, due to our industry tech, we had some brokers join the group in Melbourne who spent most of 2020 securing deals for customers they never met face-to-face.\

What will Loan Market focus on over the next six months?

Last year we announced our expansion through the acquisitions of NAB's mortgage broking businesses. A seamless introduction of PLAN Australia, Choice and FAST within the wider group is a key priority for the next six months.

It's been exciting to plan out the benefits the extended group will deliver to brokers and their customers. We really do have a wealth of knowledge to share within the expanded network.

We're really excited to welcome the new brokers into our group culture. We're a 100 per cent family-owned business – not owned by a bank. This is a different environment for these new brokers, and I'm sure they'll enjoy their newfound flexibility.

We're continuing to direct more resources to MyCRM as well. We're particularly focused on developing products which meet the unique needs of different borrower segments, such as the emergent wave of first home buyers in the marketplace.

MY TOP TIPS

Our best business owners build teams of specialists who can alleviate the busy work, allowing the lead broker to do what they do best – grow their team with the right recruits and increase business volumes."

– Loan Market executive director, network success, Andrea McNaughton

04 SHORE FINANCIAL

As the highest-ranked non-franchise brokerage, North Sydney-based business Shore Financial has been achieving great things and is a consistent high achiever in the Top 25 Brokerages ranking. This year, Shore Financial moved up two spots to rank fourth. The Adviser catches up with CEO Theo Chambers to find out what he believes are the key successes of his brokerage and why he wants to adopt a mortgage management model.

What do you attribute to Shore Financial's success?

There have been several major factors attributing to the success of Shore Financial.

First and foremost was always having a key strategy for generating business, which is constantly reviewed and developed. Our initial strategy was to generate business purely from referral partnerships with nationwide real estate groups, which we still have in place. However, our business now is less reliant on these partnerships and seeing much stronger results from a significant investment into marketing and creating brand awareness online in our core market places. This took years before we saw results. While it still isn't exactly a profitable exercise, it instead is more of a value-add and support to our broker team, diversifying their overall source of leads.

Our team culture and ethos has also equally been as important, making sure customer outcomes are the number one priority of our brokers. We have an attitude of delivering exceptional service to create raving fans that spread the good word of our brand and service.

Lastly, we have strong systems, processes and business infrastructure to support the team in their day-to-day initiatives. We have centralised processing and back-office support standardising the process, CRM systems with automated messaging for referral partners and clients, and a management team striving to make sure every broker is servicing their clients to the best of their abilities.

What was the brokerage's biggest achievement in 2020?

Our marketing team has hit new record levels of success in 2020 with a significant amount of quality leads now generated online, initially off the back of analysing topics of interest with consumers during COVID.

We used remote working to adopt new business initiatives and have improved efficiencies across the team in countless ways. We spent six months working on a rebrand (which is about to go live) along with some innovative new strategies on generating quality business online.

We hit a point where we couldn't even get to the leads we were generating, leading us to focus on a recruitment drive for new brokers, finishing the year with nine new brokers to help service the huge increase in lead generation.

What was the biggest change/initiative you made last year to help brokers support their customers during COVID?

Our centralising processing team and post-settlements customer care team is by far our number one achievement in 2020. At the start of 2020, only 20 per cent of the team were onboard with our centralised processing, which has now grown to over 70 per cent. It allows our brokers to focus purely on managing clients and leaves our processing team to deal with their administration requirements and all post-settlement enquiries, usually both of which are things a successful broker doesn't excel in, anyway.

While brokers still manage the client relationship from end to end, we believe that there needs to be constant support behind them to minimise the time they spend on processing or handling minor admin matters, maximising the time they spend on the road with clients or referral partners.

What will be Shore's main points of focus for the next six months?

We're further developing our white label product in 2021 to aim at eventually becoming a mortgage manager. We believe you need to be more than just a brokerage long-term if you want to be a successful organisation in loan services.

We are also further investing in our online marketing and brand awareness to eventually have a portion of our team purely focusing on online enquiry. This, ideally, will be a self-fulfilled online loan application process allowing us to have less reliance on brokers having to generate their own business in developing referral relationships.

Lastly, in order to achieve the above, we need to grow our annual volume to justify the cost of doing all this. Therefore, broker recruitment is a main focus now in 2021.

MY TOP TIPS

"Personally, I believe brokerage owners need to really firstly highlight to themselves why they want to own and run a leading brokerage; increasing income or creating wealth cannot be the driving reason for wanting to run a leading brokerage. Building a brand with a certain reputation and level of customer outcome needs to be the reason, as well as having a point of difference and being actually passionate about whatever your point of difference is.

"You don't need to be passionate about home loans themselves, but you need to be passionate about your vision and your brand ethos. If you don't truly believe in it yourself, then nor will anyone else."

– Shore Financial CEO Theo Chambers

05 BUYERS CHOICE MORTGAGE & FINANCE

Rounding out the top five is Victoria-based non-franchise group Buyers Choice. Making it into fifth place for the second year in a row, the brokerage experienced real growth in 2020 and settled its largest volume to date. CEO Brett Mansfield explains how the brokerage did it.

What do you attribute to Buyers Choice's success?

Buyers Choice is a very nimble business that can adapt quickly and effectively to change. This was proven in 2020 when the business was able to transition to a virtual office structure with minimal impact. Our size made it easy to quickly procure the required technology and, as our business is cloud-based, the shift was seamless, resulting in the maintenance of our support levels.

Our brokers operate in a highly supportive environment. In addition to the high-touch support delivered by the Buyers Choice staff, there is a strong community culture throughout the broker network, which means they are never isolated and alone, there is always someone to call.

The Buyers Choice business and industry profile was lifted through our sponsorship and participation in The Adviser's New Broker Academy. Through this process, we reviewed and refined our broker proposition, and the combination has resulted in our attracting new members across all states.

What was the brokerage's biggest achievement in 2020?

In the midst of a pandemic, we're proud of the way our brokers were able to navigate the fast-changing landscape and assisted their customers through the uncertainty.

This connection with the client base meant our brokers were able to grow their businesses, delivering Buyers Choice our best year of consolidated settlement volume.

Buyers Choice continued to innovate throughout the year, maintaining our planned objectives and launching a number of significant projects, including a loan processing service and an asset finance platform.

Our marketing manager led the development of an exclusive marketing support program for our brokers that resulted in the increased generation and conversion of more quality leads for their businesses.

A significant number of our brokers were also recognised during the year by various industry awards across a range of categories.

What was the biggest change/initiative you made last year to help brokers support their customers during COVID?

We always deliver a high-touch model, and throughout COVID, in particular the early stages, we increased our contact to ensure our brokers had confidence in the industry and their business. This helped to equip our brokers with the required knowledge and tools to support their customers.

Our brokers have access to a significant annual professional development program and benefit from being able to access the Buyers Choice and PLAN Australia programs. These programs are typically conference and workshop-style delivery and were not able to continue. We responded quickly to deliver weekly webinars, which resulted in the creation of a significant library of content for future viewing.

We kept our brokers informed of government assistance packages and grants and lender policy changes as they were happening, enabling them to deliver current information to their clients.

We also developed a range of social media and client communications for our brokers to utilise for their own business.

What are you focusing on for the next six months?

In 2021, we aim to consolidate on the initiatives and programs implemented in 2020 to support (what we anticipate will be) a year of strong business flows and growth for our brokers' businesses.

A priority is to assist our brokers to embed best interests duty (BID) into their business processes in an effective manner. Our loan processing service is now well established, and we consider this will be a popular solution, in particular for those brokers who are considering the need for additional resources to manage the BID changes and drive growth.

Our marketing support will remain front of mind for further enhancement, as is the continual refinement of our broker proposition to ensure it remains relevant and ensures the continuation of our strong Buyers Choice culture.

As the economy and state borders reopen, we'll revamp our Professional Development program to meet the changing environment and will focus on helping our members to grow and scale their businesses.

MY TOP TIPS

"Invest in your business before you become overwhelmed, whether this is in assets, technology or people.

Find your ideal customer and target them with your marketing. If you know who you are speaking to, the message can be loud and clear.

"It may sound obvious, but it is vital to provide a great customer experience. During 2020, the service levels from many lenders were impacted and brokers were tasked with managing customer expectations with an effective communication strategy."

– Buyers Choice CEO Brett Mansfield

Top 25 Brokerages 2021

Grow your business exponentially in 2022!

Discover the right strategies to build a more structured, efficient and profitable businesses at The Adviser's 2022 Business Accelerator Program.

Visit the website here to secure your ticket.

best online broker australia 2022

Source: https://www.theadviser.com.au/features/rankings/41278-top-25-brokerages-2021

0 Response to "best online broker australia 2022"

Post a Comment